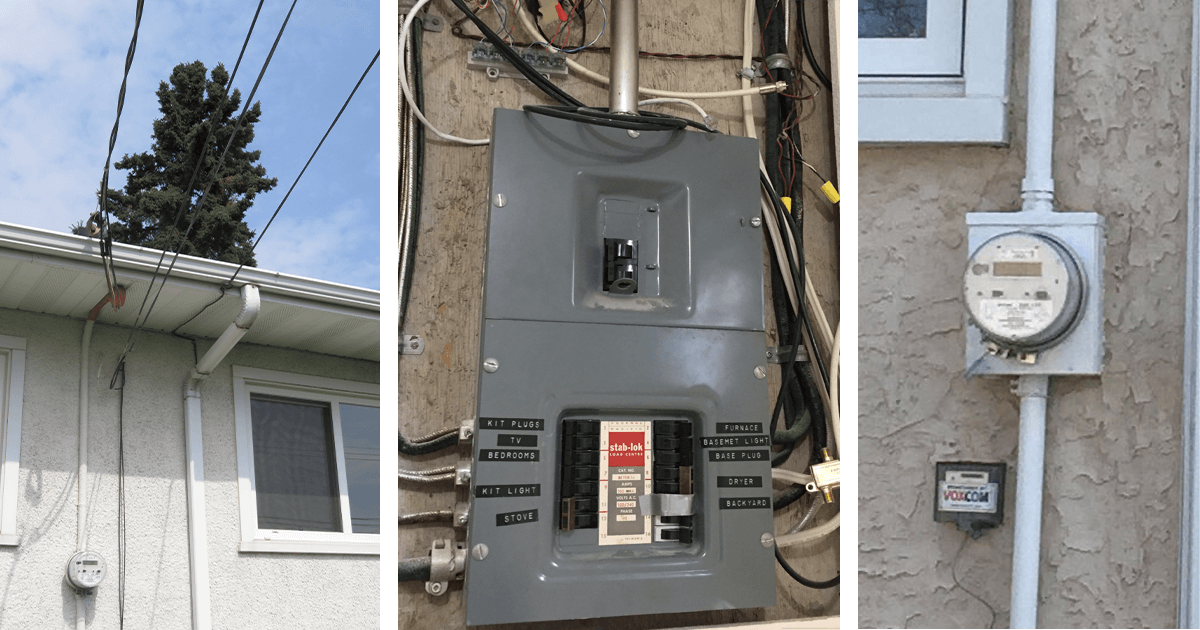

Home insurance companies, over the last number of years, have decided that it would not be in their best interest to underwrite policies for 60-amp residential electrical services. If you find yourself in need of a 60-amp service upgrade for home insurance purposes, I have identified three available options for buyers of older homes when it comes to dealing with 60-amp services.

You Have Three Options:

1. Insurance Company Refusal:

Some insurance companies refuse to provide normal home insurance for homes with 60-amp services. In such cases, you can attempt to have the upgrade done at possession (securing interim insurance from your chosen company) or, if the seller and their Realtor agree, you may opt for the upgrade before possession. This, however, can be challenging, particularly with 30-day fast-track possessions and Epcor booking appointments 5-7 weeks in advance. Leveraging our decade-long collaboration with Realtors and buyers, we’ve developed tools to help buyers navigate this issue. It’s crucial to note that if the house is uninsurable, mortgage brokers cannot issue a mortgage.

2. 90-Day Grace Period:

Some insurance companies allow up to 90 days from possession (with interim insurance) to upgrade the service to meet the 100-amp requirement. However, with modern service upgrades involving coordination between an electrical contractor, Epcor personnel, and city inspectors, scheduling may become an issue.

3. Premium Increase Option:

There is one insurance company that offers insurance on a 60-amp service, but the premiums can be up to three times the normal rate.

The best approach to handle this situation is to trust an experienced electrical contractor, such as Robart Electric, to advocate on your behalf with the city, inspectors, and Epcor to ensure a smooth and timely completion of the job.

Photo credit: freepik.com